Living in New Bedford, MA during 4 years made me notice that the Working Community is alone, without the appropriate support in many aspects of their lives. People who enjoy or are responsible with their jobs, do not have benefits such as these people who prefer stay at home or be sharing with family and friends, without the more minimum intention to work. We can review and compare some benefits that involve the working community and the people without work.

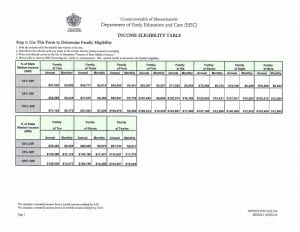

When people are working, their children are supposed to be at school or in a daycare program, in order to their parents keep their jobs. To offer this important help, The Massachusetts Department of Early Education and Care helps eligible low-income families to find and pay for child care through child care subsidies. The low-income level is defined by the State Medium Income Table.

For example, for one family of three members, the annual median income is $ 45,771 with 50% SMI; or $ 77,810 with 85% SMI; or $ 91,542.00

Another condition to get a child care voucher is that all parents or guardians in the house hold must be “working,” looking for a job, or be enrolled in school for at least 20 hours per week. However, if the parent/guardian or child has a diagnosed and documented special need, the family may qualify. At the same time, if the parent or guardian is receiving cash assistance from the Department of Transitional Assistance (DTA), they may qualify for free or low-cost child care. In the other side, families who are above the low-income level do not have any help paying for their child care services. Analyzing this situation, many parents/guardians receive child care assistance when they are unable to keep one job or one study plan. Sometimes, they are unable because they prefer stay at home doing nothing, excusing themselves with false allegation such as: companies are paying less money than before, this work is too hard, I can’t deal with the time job schedeled, etc. Becomes meaningless, that these people apply for a voucher to look for a job, and they receive it; they spend weeks and weeks and never find the job, or they find one job but they are not responsible to keep it, returning to be unemployed These people are taking money from the state, each single month; as well, they are taking food stamp from the state each month. In contrast, the working community that is aporting to the country with their work, they have to pay for child care services. In New Bedford, MA the child care rate for children under two years is $225.75 by week, and for children over two years is $173.70 or $168.70 by week, depending of the kind of voucher they have. If parents will be paying as private, the rates could be between $100-150, all depending of the program’s location or neighborhood.

Why the working community don’t deserve child care benefits? My propose is that the community should create some benefits in pro of the working community, to help them to do their valuable work every day. A good solution for this problem could be the creation of centers to take care of children which parents’ income are higher than the State Income Medium. The rates for these services could be free or at one maximum amount of $60.00 by week. The operation hours of these centers could be between 6:30 am to 12:00 am, covering two shifts with different and licensed personal. The working community deserve the right to receive help taking care of their children with respect, love, responsibly and quality. Taking that in consideration, all the employees in the center have to be licensed by The Department of Early Education and Care, and with CPR and First Aid training completed.

Another problem that is affecting the working community is the deserve to receive the credit’s benefits in the taxes. The Internal Revenue Services (IRS), have many credits to help taxpayers at the end of the year. They have the Child Tax Credit, the American Opportunity Credit, the Education Credits, the Advance Premium Tax Credit, and the most important, The Earned Income Credit. The Earned Income Tax Credit, EITC or EIC, is a benefit for working people with low to moderate income. To qualify for this credit, taxpayers must meet certain requirements and file a tax return, even if they do not owe any tax or are no required to file. EITC reduces the amount the tax taxpayers can owe and may give them a refund. In order to qualify for EITC, people must have earned income from working for someone or from running or owning a business or farm and meet basic rules. For the tax year 2017 Earned income and adjusted gross income (AGI), must each be less than:

Qualifying Children Claimed

If Filing… Zero One Two Three or more

single, head of household or widowed $15,010 $39,617 $45,007 $48,340

Married filing jointly $20,600 $45,207 $50,597 $53,930

The maximum amount of credit for Tax Year 2017 is:

- $6,318 with three or more qualifying children

- $5,616 with two qualifying children

- $3,400 with one qualifying child

- $510 with no qualifying children

Reviewing this information, we have that people with adjusted gross income less than $48,340 and $53,930 deserve a credit, a gift of a maximum of $6,318, all depending how many qualifying children they have at home. In fact, many taxpayers work every year based on these scale; they know that if they make more than “X” amount in earned income, they will receive “X” amount of credit. So, the big question here is, “Why, the working community, who work every year and make more money, reaching earned incomes over these limits do not deserve and receive any credits? It is like, we have to celebrate that people earn income until certain amount, and we disparage the effort of people who work without thinking about of make a specific amount of income to get free money or credit.

I believe that people who exceed these limits could receive a credit in honor of their valuable work in the society. For example, if a person has one adjusted gross income of $100,400, they could receive a credit for making too much money working in pro of the community. In fact, in New Bedford, Massachusetts all the benefits are around of the people earned income. Also, if we work together creating some benefits in pro of the working community, we will have a healthy community, with motivation to grow and achieve better living standards.

Another disadvantage of the working community is about the limits in the income, in order to receive any help when people are buying a house. In New Bedford, Massachusetts, people who exceed the amount of $ 66,500 by year; or $82,104 by year; do not qualify for the ONE program. Another topic, is that people who exceed certain limits of income are disqualified to receive free health insurance, and have to pay high amounts for this concept.

Establish limits to obtain credits at the end of the year is perjudicial to the community, because in this way our people are limited in their lives and our community is not growing. When our community start to thinking about these problems, and start creating new rules in pro of the working community; they will have healthy people working for their goals, without be living from the state and their subsidies.

The Massachusetts Department of Early Education and Care, EEC. 606 CMR 7.00: Standards For The Licensure or Approval of Family Child Care; Small Group and School Age and Large Group and School Age Child Care Programs.

Pace Child Care Works Website. How to Obtain a Voucher for Child Care. “The Massachusetts Department of Early Education and Care helps eligible low-income families to find and pay for child care through child care subsidies…” website: pacechildcareworks.com

Internal Revenue Service, IRS. 2017 EITC Income Limits, Maximum Credit Amounts and Tax Law Updates. “The Earned Income Tax Credit, EITC or EIC, is a benefit for working people with low to moderate income.” website: www.irs.gov